Welcome To

Oldham Group

Compass

2021 National TV Host, American Dream TV

2020, Austin Business Journal #24 Individual Agent, Winner

2018 Austin Business Journal #15 Individual Agent, Winner

2015, 2016, 2017 & 2018 Platinum Top 50 Award Winner

Top Properties

Recent Posts

Updates Friday April 26, 2024

Updates Friday April 19, 2024

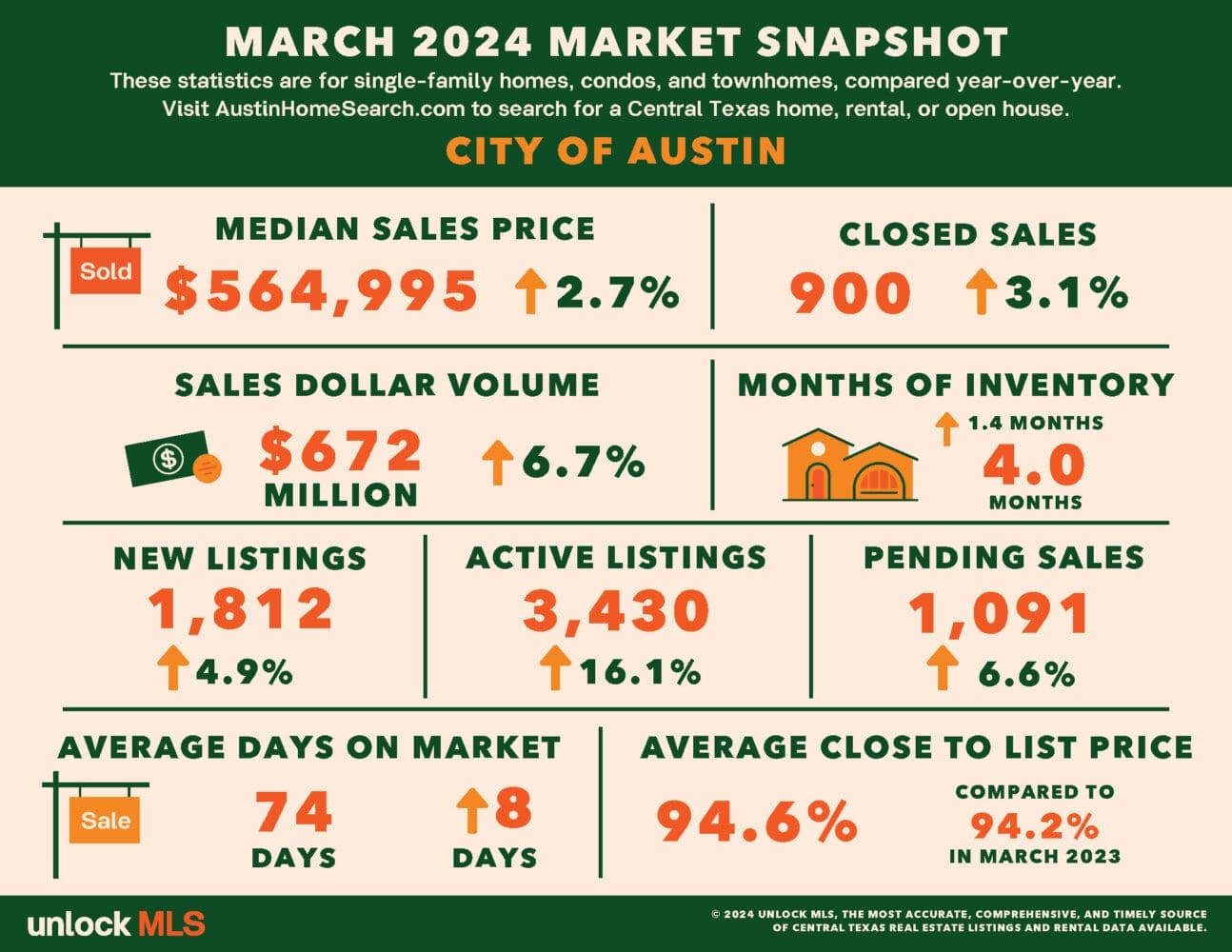

Austin Stats

Austin March 2024 Statistics

Westlake Office

Located in downtown Austin allows us to hold meetings at your convenience.

Austin/Westlake

2500 Bee Caves Road, Bldg 3, Ste 200

To book a private appointment…

Please call +1-512-809-5495 or Email us [email protected]

A Few Oldham Group Specialties

The Oldham Group is a team of real estate agents affiliated with Compass. Compass is a licensed real estate broker and abides by all applicable Equal Housing Opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but is subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. No statement is made as to accuracy of any description. All measurements and square footages are approximate. This is not intended to solicit property already listed. Nothing herein shall be construed as legal, accounting or other professional advice outside the realm of real estate brokerage.

© 2024 The Oldham Group

|